Market Research: Stainless Steel Press Fittings

Market Overview

Stainless steel press fittings are a modern piping solution that uses a mechanical press tool to create secure, leak-proof connections without welding, soldering, or threading. Valued for their corrosion resistance, durability, and installation efficiency, they cater to plumbing, industrial, and infrastructure needs worldwide. The global press fittings market (encompassing stainless steel, copper, and carbon steel variants) was valued at approximately USD 3.13 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 4.3–4.9% through 2030, potentially reaching USD 4.68–5 billion by 2031. Stainless steel press fittings hold a significant share due to their superior material properties and versatility.

Key Market Drivers

Urbanization and Construction Growth: Rapid urban development in Asia-Pacific, Middle East, and Africa fuels demand for plumbing and HVAC systems in residential and commercial buildings. Stainless steel press fittings reduce installation time by up to 50% compared to traditional methods.

Industrial Applications: Sectors like food and beverage, pharmaceuticals, and chemicals prioritize stainless steel for its hygienic, non-reactive nature, driving adoption in processing plants globally.

Sustainability Push: Stainless steel’s 100% recyclability aligns with green building codes (e.g., LEED) and circular economy goals, enhancing its appeal over copper or plastic alternatives.

Labor Efficiency: Eliminating welding cuts labor costs and skill requirements, a major advantage in high-wage markets like North America and Western Europe.

Harsh Environment Demand: Mining, marine, and oil/gas industries in regions like Australia, the Middle East, and North Sea rely on stainless steel’s corrosion resistance.

Market Segmentation

By Material:

Stainless steel (dominant due to corrosion resistance; grades like 304 and 316L are common).

Copper and carbon steel (cheaper alternatives but less durable in corrosive settings).

By Application:

Plumbing (potable water, heating/cooling systems): ~40% of market share.

Industrial (food processing, chemical plants): ~30%.

Gas distribution and fire suppression: ~15%.

Others (marine, mining): ~15%.

By End-User:

Commercial (offices, hotels): 35%.

Residential: 30%.

Industrial: 25%.

Infrastructure (water treatment, utilities): 10%.

By Region:

Asia-Pacific: Largest market (~50% share), led by China, India, and Southeast Asia’s industrial and construction boom.

Europe: Mature market (~25%), driven by retrofitting and strict quality standards (e.g., DVGW in Germany).

North America: Steady growth (~15%), with focus on commercial and industrial upgrades.

Middle East & Africa: Emerging (~7%), tied to oil/gas and urban projects (e.g., Saudi Vision 2030).

Latin America: Smaller but growing (~3%), led by Brazil and Mexico’s manufacturing sectors.

Competitive Landscape

Key Players:

Viega (Germany): Pioneer in press-fitting systems, strong in Europe and North America.

Victaulic (USA): Offers a broad range of stainless steel solutions for industrial use.

Raccorderie Metalliche (Italy): Specializes in high-grade stainless steel fittings.

Sanha (Germany): Focuses on plumbing and HVAC applications.

Geberit (Switzerland): Known for Mapress stainless steel systems in plumbing.

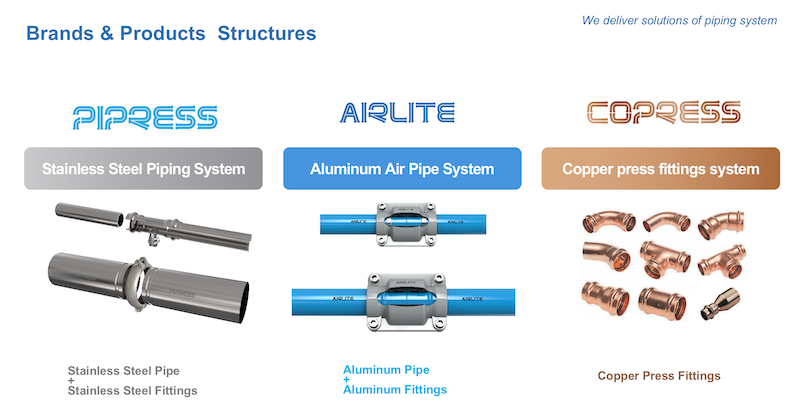

Regional Players: Europress (Australia), Conex Bänninger (UK/Middle East), and various Chinese manufacturers: PIPRESS etc.

Market Share: Top 5 players hold ~40–45% of the market, with the rest fragmented among local suppliers and OEMs.

Trends and Opportunities

Technological Innovation: Smart press tools with sensors ensure consistent joint quality, boosting reliability and adoption in critical applications.

Certifications Drive Sales: Compliance with standards like ASME (USA), EN (Europe), and JIS (Japan) is key to entering regulated markets.

Prefabrication Growth: Off-site assembly of press-fit systems reduces on-site labor, appealing to large-scale projects.

Emerging Markets: India, Vietnam, and Africa offer untapped potential due to rising infrastructure investments.

Exhibition Marketing: Trade shows (e.g., ISH Frankfurt, AHR Expo USA) provide platforms to showcase brands like PIPRESS to global buyers.

Challenges

Raw Material Costs: Nickel and chromium price volatility (e.g., nickel surged 20% in 2024) impacts stainless steel pricing, squeezing margins.

Competition from Alternatives: Copper press fittings and PEX piping are cheaper in residential markets, challenging stainless steel’s dominance.

Skill Awareness: In developing regions, lack of familiarity with press-fit technology slows adoption.

Counterfeit Products: Low-quality knockoffs from unregulated markets undermine trust in stainless steel fittings.Regional Insights

Asia-Pacific: China’s manufacturing and India’s urbanization (e.g., Smart Cities Mission) drive demand. Stainless steel imports grew 15% in 2024.

Europe: Focus on energy-efficient buildings and water safe.

Feb 26, 2025